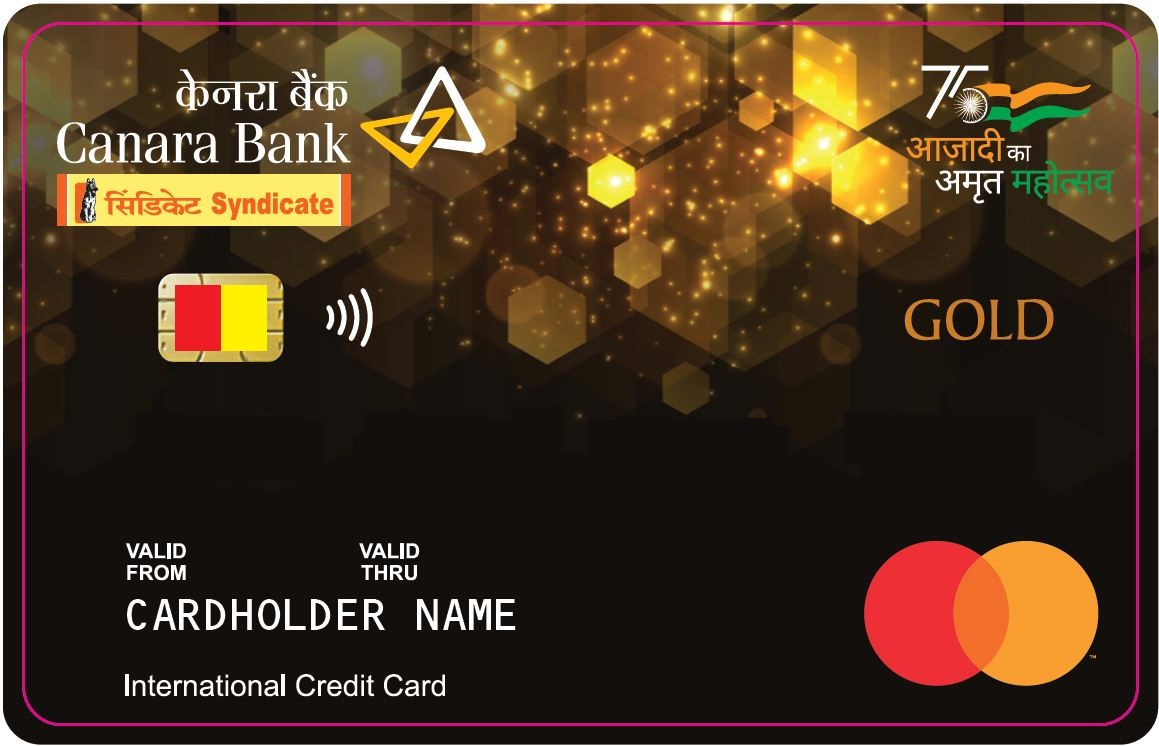

Mastercard Gold Secured Credit Card

Rewards & Benefits

Welcome Benefits

None

Milestone Benefits

Cashback Rate

Effective cashback rate: 0.50%.

Users will earn 2 reward points for every Rs. 100 spent on credit cards. Value of 1 reward point = Rs.0.25. Effective cashback rate: 0.50%.

Movie Benefits

Dining Benefits

Other Benefits

Users will receive offers/discounts at select online and POS merchants from time to time.; Users will get a baggage insurance of up to Rs 25,000.; No annual and renewal fees.

Lounge Access

Fees & Charges

Joining Fee

NIL

Annual Fee

Annual membership fee: NIL

Cash Advance Fee

Cash advance fee: 3% of the transaction amount subject to a minimum of Rs. 30 for every Rs. 1000 or part thereof.

Interest rate

2.50% monthly, 30% annually.

Late Payment Fee

Late payment charges: Rs. 250

Foreign Currency Transactions Fee

Foreign currency markup fee: Up to 3%.

Other Fees

Reward redemption fee: It will be displayed while redeeming the points. | Fuel surcharge: 1%

Cons

Low general cashback rate.

No welcome benefits.

No milestone benefits.

Reward system: Users will earn 2 reward points for every Rs. 100 spent on credit cards. Value of 1 reward point = Rs.0.25. Effective cashback rate: 0.50%.

Users will receive offers/discounts at select online and POS merchants from time to time.

Users will get a baggage insurance of up to Rs. 25,000.

No annual and renewal fees.

Rewards & Benifits

Welcome Benefits

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Rewards System

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

International Forex Markup

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Welcome Benefits and Reward System

Special Features

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Eligibility Criteria

Independent income with a minimum of ₹. 2 Lakh gross per annum for individuals.

Minimum annual gross income of Rs.60000/- and minimum net take home salary of not less than Rs.4000/- p.m. for staff members.

The applicant needs to have a Fixed Deposit with the Canara Bank.

Speical Feature, Eligibility and Benefits

How to apply for Credit Card?

Online Application:

Visit the Canara Bank Website: Go to the official Canara Bank website.

Locate the Credit Card Section: Look for the "Credit Cards" or "Apply Online" section.

Mastercard Gold Secured Credit Card: Choose the Mastercard Gold Secured Credit Card from the available options.

Fill the Application Form: Provide the required personal and financial information, such as your name, address, income, and employment details.

Upload Documents: Upload the necessary documents, including proof of identity, address, and income.

Submit the Application: Review your application and submit it online.

Offline Application:

Visit a Canara Bank Branch: Go to your nearest Canara Bank branch.

Request an Application Form: Ask the bank staff for a Mastercard Gold Secured Credit Card application form.

Fill the Application Form: Complete the form with the required information.

Submit the Application: Submit the filled form along with the necessary documents to the bank staff.

Contact Details

Call: 13 1800 1030

Account Opening and Procedure

Recommended Credit Cards

Pros:-

Change the text to include your own content. Adjust the font, size or scale to customize the style.

Cons:-

Reward system: Users will earn 2 reward points for every Rs. 100 spent on credit cards. Value of 1 reward point = Rs.0.25. Effective cashback rate: 0.50%.

Users will receive offers/discounts at select online and POS merchants from time to time.

Users will get a baggage insurance of up to Rs. 25,000.

No annual and renewal fees.

Low general cashback rate.

No welcome benefits.

No milestone benefits.

The card offers low cashback rate. The card is offered against fixed deposit. The card offers minimal value add features. Overall the card is recommended only for those individuals whose credit score is not good enough to get a non-secured credit card.

The card offers low cashback rate. The card is offered against fixed deposit. The card offers minimal value add features. Overall the card is recommended only for those individuals whose credit score is not good enough to get a non-secured credit card.

Abhijeet Saxena

Abhijeet Saxena

Nalsar University of Law

Ex- Senior Associate, Shardul Amarchand Mangaldas, Delhi

Ex - Khaitan & Co. Bengaluru,

Ex - National Stock Exchange, Mumbai,

Ex - Argus Partners, Mumbai

Product Review

Fees & Charges

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Fuel Surcharge

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Billing Cycle

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.