top of page

.webp)

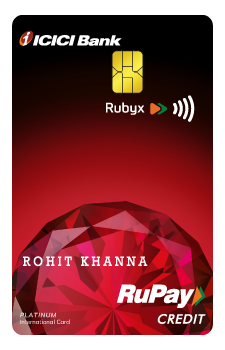

Credit Card

Explore India's largest collection of unbiased credit card reviews. All credit cards reviews are unpaid and the rating provided by us is completely objective. Compare the pros, cons, special features and various fees associated with credit cards.

bottom of page