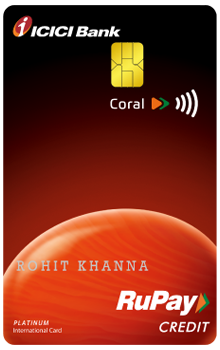

ICICI Bank Coral RuPay Credit Card

Rewards & Benefits

Welcome Benefits

None

Milestone Benefits

Milestone benefit: Users will get 2000 reward points on spending Rs 2,00,000 on their card and 1000 reward points each time they cross Rs 1,00,000 spending thereafter in an anniversary year, a maximum of 10,000 reward points per year.

Cashback Rate

The value of 1 reward point for ICICI Bank Coral credit card is Rs. 0.25.

Users will earn 2 reward points on every Rs. 100 spent on their card (except fuel), effective cashback rate: 0.50%.

Users will earn 1 reward point on every Rs.100 spent on utilities and insurance categories, effective cashback rate: 0.25%.

Movie Benefits

Movie Offer: Customers can also avail 25% discount, of ₹ 100 on BookMyShow and Inox.

Dining Benefits

Other Benefits

Lounge Access

Fees & Charges

Joining Fee

Rs 500+GST

Annual Fee

Rs 500+GST

Cash Advance Fee

2.50% of the amount or ?300, whichever is higher.�

Interest rate

3.50%p.m. and 42%p.a.

Late Payment Fee

Late payment charges: ₹ 100 per instance.

Foreign Currency Transactions Fee

3.50%

Other Fees

Cash advance charges: 2.50% of the amount or ₹300, whichever is higher.

दोष

Basic rewards: Compared to other cards, the 2x point rate is relatively low.

Limited lounge access: Only one visit per quarter might not be sufficient for frequent travellers.

Movie benefit restrictions: Applicable only twice a month with limited ticket value.

Rewards system: The value of 1 reward point for ICICI Bank Coral credit card is Rs. 0.25. Users will earn 2 reward points on every Rs. 100 spent on their card (except fuel), effective cashback rate: 0.50%. Users will earn 1 reward point on every Rs.100 spent on utilities and insurance categories, effective cashback rate: 0.25%.

Milestone benefit: Users will get 2000 reward points on spending Rs. 2,00,000 on their card and 1000 reward points each time they cross Rs. 1,00,000 spending thereafter in an anniversary year, a maximum of 10,000 reward points per year.

Travel Benefits: Customers can avail 1 complimentary access, per quarter, to select airport lounges in India. You need to spend Rs. 75,000 in the preceding calendar quarter to unlock complimentary access for the subsequent calendar quarter. Users will also get one complimentary domestic railway lounge visit.

Users can link their RuPay credit card directly to their UPI app.

Users will get exclusive offers on dining, through "ICICI Bank Culinary Treats Programme".

Users will get a Personal Accident insurance cover of ₹2 lakh.

Users will get 24x7 Concierge services.

Movie Offer: Customers can also avail 25% discount, of ₹ 100 on BookMyShow and Inox.

पक्ष विपक्ष

Welcome Benefits

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

पुरस्कार प्रणाली

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

अंतर्राष्ट्रीय विदेशी मुद्रा मार्कअप

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

स्वागत लाभ और पुरस्कार प्रणाली

विशेष लक्षण

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Eligibility Criteria

Age:

Primary cardholder: Must be above 21 years old.

Supplementary cardholder: Must be above 18 years old (some variants might have a higher minimum age).

Nationality:

Must be an Indian citizen.

Occupation:

Salaried, self-employed, or professional.

Minimum Income:

This varies depending on your location and card variant. For example, in Indore, Madhya Pradesh, the minimum income requirement for the Coral Credit Card might be around Rs. 25,000 per month for salaried individuals and Rs. 40,000 per month for self-employed individuals.

Credit Score:

You should have a good credit score to be eligible for the card. ICICI Bank doesn't specify the minimum score, but generally, a score above 700 is considered good.

विशेष विशेषता, पात्रता और लाभ

क्रेडिट कार्ड के लिए आवेदन कैसे करें?

Eligibility: You must be at least 18 years old with a regular source of income and meet the bank's minimum credit score requirements.

Apply online: Visit the ICICI Bank website (https://www.icicibank.com/personal-banking/cards/credit-card/coral-card) and fill in the application form.

Documents required:Proof of identity (PAN card, Aadhaar card, etc.)

Proof of address (driving license, utility bills, etc.)

Income proof (salary slips, ITR documents, etc.)

Processing & approval: The bank will process your application and check your credit score. You will be notified of the decision within a few days.Card delivery: Once approved, your card will be delivered to your registered address within 7-10 business days.

सम्पर्क करने का विवरण

1800 1080

खाता खोलने की प्रक्रिया और प्रक्रिया

विशेष विशेषता, पात्रता और लाभ

Pros:-

Change the text to include your own content. Adjust the font, size or scale to customize the style.

Cons:-

Rewards system: The value of 1 reward point for ICICI Bank Coral credit card is Rs. 0.25. Users will earn 2 reward points on every Rs. 100 spent on their card (except fuel), effective cashback rate: 0.50%. Users will earn 1 reward point on every Rs.100 spent on utilities and insurance categories, effective cashback rate: 0.25%.

Milestone benefit: Users will get 2000 reward points on spending Rs. 2,00,000 on their card and 1000 reward points each time they cross Rs. 1,00,000 spending thereafter in an anniversary year, a maximum of 10,000 reward points per year.

Travel Benefits: Customers can avail 1 complimentary access, per quarter, to select airport lounges in India. You need to spend Rs. 75,000 in the preceding calendar quarter to unlock complimentary access for the subsequent calendar quarter. Users will also get one complimentary domestic railway lounge visit.

Users can link their RuPay credit card directly to their UPI app.

Users will get exclusive offers on dining, through "ICICI Bank Culinary Treats Programme".

Users will get a Personal Accident insurance cover of ₹2 lakh.

Users will get 24x7 Concierge services.

Movie Offer: Customers can also avail 25% discount, of ₹ 100 on BookMyShow and Inox.

Basic rewards: Compared to other cards, the 2x point rate is relatively low.

Limited lounge access: Only one visit per quarter might not be sufficient for frequent travellers.

Movie benefit restrictions: Applicable only twice a month with limited ticket value.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Application Procedure

Abhijeet Saxena

Abhijeet Saxena

Nalsar University of Law

Ex- Senior Associate, Shardul Amarchand Mangaldas, Delhi

Ex - Khaitan & Co. Bengaluru,

Ex - National Stock Exchange, Mumbai,

Ex - Argus Partners, Mumbai

उत्पाद समीक्षा

फीस एवं प्रभार

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

ईंधन अधिशुक्ल

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Billing Cycle

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.