Aztec Fluids & Machinery Limited IPO Review

Aztec Fluids & Machinery Limited is a prominent name in the manufacturing sector, known for its comprehensive range of printers, printer consumables, and printer spares. The company was founded in April 2010 and is headquartered in Ahmedabad, Gujarat. It was established with the vision to provide quality-assured products to various industries, including personal care, food and beverages, pharmaceuticals, construction materials, cables, wires, and pipes, metals, automotive and electronics, agrochemicals, and chemicals and petrochemicals.

The company is the brainchild of the Vaidya family, with Pulin Kumudchandra Vaidya, Amisha Pulin Vaidya, and Kumudchandra Bhagwandas Vaidya at the helm as the promoters. Their leadership has steered the company towards innovation and excellence, ensuring that Aztec Fluids & Machinery Limited remains a leader in its domain.

Aztec Fluids & Machinery Limited has its roots firmly planted in Ahmedabad, Gujarat, a city known for its vibrant business culture and entrepreneurial spirit. From this city, the company has expanded its reach to various parts of the world, exporting its products to countries like Sri Lanka, Nepal, Bhutan, Bangladesh, Kenya, and Nigeria.

The inception of Aztec Fluids & Machinery Limited was driven by the need to offer operational cost efficiency and quality products in the coding and marking segment of the manufacturing industry. The company's foundation was laid with a commitment to addressing the key concerns of operational costs while maintaining stable and high-quality product standards.

The company's journey began with a clear focus on innovation and customer satisfaction. Over the years, it has developed a diverse product portfolio that caters to the needs of various industries. The product range includes continuous inkjet printers, thermal transfer over printers, drop-on-demand printers, piezoelectric printers, and laser printers. These products enable clients to print variable information like batch numbers, logos, barcodes, and promotional codes on different materials such as glass, steel, plastics, and packaging.

Aztec Fluids & Machinery Limited has also been proactive in forming strategic partnerships and enhancing its infrastructure to support growth. The company's registered office in Ahmedabad supports regional offices in Mumbai, Kolkata, and Hyderabad, while its warehouse in Kanera serves as a base for printer assembly, configuration, and testing.

Competitive Strengths

Aztec Fluids & Machinery Limited (AFML) is a company that has carved a niche for itself in the highly competitive and fragmented industry of printing solutions. Founded in April 2010, AFML has established itself as a provider of a wide array of printers, printer consumables, and printer spares to various industries, including personal care, food and beverages, pharmaceuticals, construction materials, cables, wires, and pipes, metals, automotive and electronics, agrochemicals, chemicals, and petrochemicals.

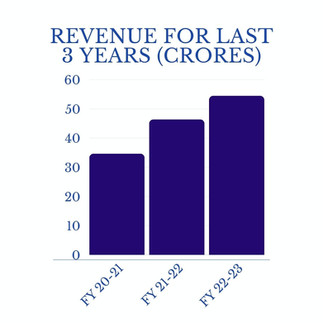

Revenue, Sales, and Profit

Aztec Fluids & Machinery Limited has reported a range of operating revenue between INR 1 crore to 100 crores for the financial year ending on March 31, 2021. The company's net worth has seen a significant increase of 35.16%, while its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has risen by 61.74%. This growth in EBITDA suggests a robust operational performance. The total assets of the company have also increased by 12.23%, indicating a solid expansion in the company's asset base. However, liabilities have concurrently increased by 4.34%, which is relatively modest compared to the growth in assets. For the year ending March 31, 2023, the net sales/income was reported at 54.26 crores, with a net profit of 3.27 crores. This profit figure represents an improvement over the previous year's net profit of 3.11 crores, reflecting a positive trend in profitability. The company's financial health can also be gauged by its debt-to-equity ratio, which stood at 0.69, and a return on equity of 25.70%, which are indicators of financial stability and efficiency.

Distribution Network and Geographical Reach

Aztec Fluids & Machinery Limited, established in April 2010, has expanded its distribution network to cater to a diverse range of industries with its quality-assured assortment of printers, printer consumables, and printer spares. The company boasts a significant install base of over 3500 printers across India and has extended its geographical reach beyond its home country. It has a presence in several African nations including Kenya, Uganda, Mozambique, Cameroon, and Nigeria, as well as in Nepal, Bangladesh, and New Zealand. This extensive network is indicative of Aztec's commitment to meeting the demands of various sectors such as personal care, food and beverages, pharmaceuticals, construction materials, cables, wires, pipes, metals, automotive electronics, agrochemicals, chemicals, and petrochemicals. The company's products are highly regarded for their supreme quality, excellent performance, long functional life, and easy operations, which has helped them establish a strong foothold in markets of the Indian Subcontinent, East Asia, Middle East, and South East Asia.

Unique Features

Aztec Fluids & Machinery Limited (AFML) is a company that stands out in the coding and marking industry with its comprehensive range of products and services. AFML provides innovative solutions to a variety of sectors including personal care, food and beverages, pharmaceuticals, and more. Their product line includes advanced printers like continuous inkjet, thermal transfer overprinters, and laser printers, which are essential for printing variable information such as batch numbers and barcodes on products. Additionally, AFML offers a diverse color palette of printer inks and consumables like makeup and cleaning solvents, catering to specific industry needs. The company's commitment to quality is evident in their in-house manufacturing of consumables and their two registered patents on cartridge design, ensuring a high standard of product integrity. Furthermore, AFML's strategic partnership with Lead Tech and their robust distribution network across multiple countries highlight their global reach and expertise in the field.

Investment in Research and Development

Aztec Fluids & Machinery Limited (AFML) has demonstrated a commitment to innovation and quality through its investment in research and development (R&D). The company's R&D wing is a cornerstone of its operations, staffed by experienced associates who conduct extensive market research and stay abreast of advancements in science and technology. This dedication to R&D has led to the development of a diverse product portfolio, including a range of printers and inks tailored to various industries. AFML's collaboration with Lead Tech (Zhuhai) Electronic Co. Ltd., China, for exclusive distribution rights in several countries, and its manufacturing agreement with Fluidtech Corp, highlight the company's strategic approach to R&D investment. Furthermore, AFML's ownership of two registered patents on cartridge design underscores its focus on innovation and intellectual property. These efforts in R&D not only enhance the company's product offerings but also strengthen its competitive position in the market.

Aztec Fluids & Machinery Limited IPO Details

Issue Date: The Issue Date in an Initial Public Offering (IPO) refers to the specific day when a company's shares are first made available for public purchase on the stock market. This date is a critical milestone in the IPO process, marking the transition of a company from private to public status and allowing investors to buy shares directly from the company for the first time. (Issue Date: May 10, 2024 to May 14, 2024).

Listing Date: The listing date refers to the day when the company's shares are officially listed and begin trading on a stock exchange. This is typically several business days (3-6 days) after the issue date after processes like share allotment and finalization are completed. On this date, investors who were allotted shares during the IPO can begin selling them, and new investors can start purchasing them on the exchange at the prevailing market price. (Listing Date: Friday, May 17, 2024).

Face Value of Shares: The face value of shares in an Initial Public Offering (IPO) refers to the original cost of the shares as determined by the company going public. It represents the nominal value and is often set at a lower figure, such as Rs. 10 or Rs. 100, which remains constant irrespective of the market price of the share after the company is listed on the stock exchange. When a company launches an IPO, the shares are typically offered at a price that includes this face value plus an additional premium, which reflects the current market valuation of the company. The premium over the face value is determined by the company's financial performance and future growth prospects as assessed by the investment bankers managing the IPO. (Face Value: ₹10 per share).

Price Band: A price band of an IPO is the range of prices within which the investors can bid for the shares of a company that is going public. The price band is set by the issuer and the lead managers of the IPO, based on various factors such as the demand and supply of the shares, the financial performance and valuation of the company, and the market conditions. (IPO Price: ₹63-₹67 per share).

Lot Size: In the context of an Initial Public Offering (IPO), the term "lot size" refers to a fixed number of shares that the issuing company sets as the minimum quantity that investors can apply for. This lot size is predetermined before the IPO and is mentioned in the application forms. The lot size varies from one company to another and is an important factor for investors to consider when applying for an IPO. (Lot Size: 2000 Shares).

Total Issue Size: The total issue size represents the total number of shares the company is offering to raise capital through the IPO. This number is determined by the company and its advisors, considering factors like their funding needs and the expected investor demand. The total issue size is then divided by the lot size to determine the total number of lots available for purchase by investors. (Total Issue Size: 3,600,000 shares (aggregating up to ₹24.12 Cr)).

Fresh Issue: A Fresh Issue in the context of an Initial Public Offering (IPO) refers to the creation and sale of new shares by a company to the public. Unlike an Offer for Sale, where existing shareholders sell their shares, a Fresh Issue results in the generation of new capital for the company. This capital is typically used for growth initiatives such as expansion, research and development, or debt repayment. (Fresh Issue: 3,600,000 shares (aggregating up to ₹24.12 Cr)).

Issue Type: The type of an IPO can vary depending on the market and regulatory conditions. Some of the common types of IPOs are, Fixed priced IPO, Auction IPO, Book Building IPO, and Hybrid IPO. (Issue Type: Book Build Issue IPO).

Listing At: An integral part of the IPO process is the listing. This refers to the day the company's shares officially begin trading on a stock exchange, such as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE) in India. Once listed, anyone with a brokerage account can buy and sell the company's shares on the exchange. (Listing at: BSE SME).

Retail Shares Offered: Retail shares offered in an IPO refer to the portion of shares that are specifically allocated for individual investors, as opposed to institutional investors. These shares are part of the public offering where companies going public aim to raise capital by selling shares. Retail investors are typically allocated a certain percentage of the total shares available for the IPO. The allotment process for retail investors is designed to be fair and transparent, ensuring that all investors have an equal chance of receiving shares based on their application and market conditions. (Retail Shares Offered: Not less than 35.00% of the Offer ).

QIB Shares Offered: QIBs are institutional investors such as banks, mutual funds, insurance companies, pension funds, etc., who have the expertise and financial resources to invest in the securities market. They are considered as informed and sophisticated investors who can assess the risks and returns of an IPO. QIBs can bid for up to 50% of the total shares offered in an IPO via the profitability route, or up to 75% of the total shares offered in an IPO via the QIB route. QIBs have to pay only 10% of the bid amount at the time of application, and the rest after the finalization of the basis of allotment. (QIB Shares Offered: Not less than 50.00% of the Offer ).

NII (HNI) Shares Offered: NII stands for Non-Institutional Investors, which includes High Net-worth Individuals (HNIs) who bid for shares worth more than ₹200,000. The NII category is reserved for investors who do not fall under the retail or Qualified Institutional Buyers (QIBs) categories. Typically, a certain percentage of the IPO, usually around 15%, is allocated for NIIs to ensure a wider distribution of shares. HNIs within the NII category often have a higher chance of allotment compared to retail investors, making it an attractive option for those looking to invest larger sums in an IPO. (NII (HNI) Shares Offered: Not less than 15.00% of the Offer).

Competitors of Aztec Fluids & Machinery Limited

Aztec Fluids & Machinery Limited, a company known for manufacturing and providing printers, ink, and solvents, operates in a competitive industry that is marked by the presence of several key players. The landscape of competition is diverse, encompassing companies that specialize in printed, functional, and decorative products for various industries, including electronics and automotive.

One of the main competitors of Aztec Fluids & Machinery Limited is CCL Design, which has established itself as a manufacturer of printed products catering to the industrial, electronics, and automotive sectors. With a significant employee base, CCL Design represents a formidable presence in the market.

Another competitor is Hanson Sign, a company that focuses on the production of custom signs. Although smaller in scale compared to CCL Design, Hanson Sign's specialization in signage represents a niche area of competition.

LexJet is also among the competitors, carving out its market share by manufacturing, marketing, and selling inkjet printing equipment and supplies. LexJet's operations span across various locations, indicating a robust distribution and sales network.

Tricomas Marketing, based in Malaysia, competes in the manufacturing, supply, and distribution of printing and imaging machines. This company's geographical reach extends to several key markets in Malaysia, showcasing its strategic placement in the Asian market.

These competitors vary in size, specialization, and market strategy, but they all share the common goal of innovating and capturing market share in the printing and machinery industry. Aztec Fluids & Machinery Limited must navigate this competitive landscape by focusing on product quality, technological advancement, customer service, and market expansion to maintain and enhance its position in the market.

The competitive dynamics of the industry are ever-evolving, with companies continuously striving to outperform each other through innovation, strategic partnerships, and expansion into new markets. For Aztec Fluids & Machinery Limited, staying ahead of the curve will require a keen understanding of market trends, customer needs, and the agility to adapt to the changing business environment.

Conclusion

In conclusion, the IPO of Aztec Fluids & Machinery Limited presents a noteworthy opportunity for investors. With the issue opening on May 10, 2024, and closing on May 14, 2024, the company has set a price band of ₹63 to ₹67 per share. The financial metrics suggest a robust outlook, with an EPS of 3.27 and a P/E ratio of 21.32, indicating a potentially profitable investment. However, as with any investment, it is crucial to consider the associated risks and conduct thorough research. The positive sentiment from analysts and the detailed IPO information available provide a solid foundation for making an informed decision. Ultimately, the success of this IPO will depend on market conditions and investor confidence in Aztec Fluids & Machinery's growth trajectory and business model. Investors are advised to evaluate their investment goals and risk appetite in the context of the company's performance and market trends before participating in the IPO.

Please Read the Detailed Review Here.

Disclaimer: This is not an investment advisory. The article above is for information purposes only. Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing securities, that suit your needs. The performance and returns of any equity stock can neither be predicted nor guaranteed.

FAQs

Q: What is an IPO?

An Initial Public Offering (IPO) is a process through which a privately held company offers its shares to the public for the first time and becomes a publicly traded company.

Q: How can I apply for an IPO?

You can apply for an IPO through various methods:

ASBA (Application Supported by Blocked Amount): In this method, your application money remains in your bank account until the basis of allotment is finalized.

UPI (Unified Payment Interface): You can authorize the blocking of funds in your bank account using UPI while applying for an IPO.

Q: What is ASBA?

ASBA stands for Application Supported by Blocked Amount. It allows your application money to be blocked in your bank account during the IPO bidding process. You continue to receive interest on the blocked amount.

Q: What is the difference between book building and a normal public issue?

Book building is a process where demand for securities is elicited and the price is assessed based on investor bids. In a normal public issue, the price is fixed by the issuer.

Q: Can I make payments through UPI for IPOs?

Yes, you can use UPI as a payment method for IPOs. The UPI platform blocks the funds for IPO applications after you approve the fund block mandate request.

Q: What is the minimum order quantity for an IPO?

The minimum number of shares you can apply for in an IPO is known as the minimum order quantity. It varies for each IPO.

Q: What is the cut-off price in an IPO?

The cut-off price is the price at which you bid for shares without specifying a particular price. It allows you to participate in the IPO without specifying a specific bid price.

Q: Can I revise my bids during the IPO process?

Yes, you can revise your bids multiple times before the IPO bidding period ends.

Q: Which banks offer the ASBA facility for IPOs?

Several banks, known as Self Certified Syndicate Banks (SCSBs), offer the ASBA facility. Some examples include HDFC Bank, ICICI Bank, Axis Bank, and SBI.

Q: How do I find IPO mandates on UPI apps?

You can check the list of UPI handles supported for IPO payments on the National Payments Corporation of India (NPCI) website. These handles allow you to apply for IPOs using UPI.

Comments