.webp)

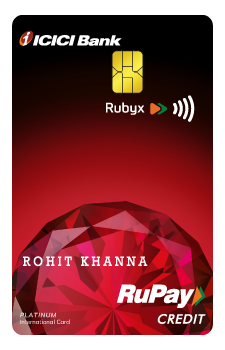

Credit Card

Explore India's largest collection of unbiased credit card reviews. All credit cards reviews are unpaid and the rating provided by us is completely objective. Compare the pros, cons, special features and various fees associated with credit cards.

Interest Rate

Balances less than Rs. 10 Crore - 2.70% p.a.

0

Account Opening Fee

0

Annual Maintenance Fees

Salary Account

Account Type

Interest Rate

Up to INR 1 Lakh: 2.75%

Above INR 1 Lakh and up to INR 10 Lakh: 2.75%

Above INR 10 Lakh and up to INR 50 Lakh: 2.75%

Above INR 50 Lakh and up to INR 100 Lakh: 3.5%

0

Account Opening Fee

0

Annual Maintenance Fees

Savings

Account Type

Interest Rate

Less than Rs. 50 Lakh-3.00% p.a. and Rs. 50 Lakh and up to less than Rs. 800 Crs-3.50% p.a.

0

Account Opening Fee

0

Annual Maintenance Fees

Saving account

Account Type

Interest Rate

Less than Rs. 50 Lakhs-3.00% p.a. and Rs. 50 Lakhs and up to less than Rs. 800 Crs-3.50% p.a..

0

Account Opening Fee

0

Annual Maintenance Fees

Salary Account

Account Type

Interest Rate

Upto and including 1 lakh - 4.50%

Above 1 lakh and including 5 lakh - 6.00%

Above 5 lakh and including 1 Cr - 7.00%

Above 1 Cr and including 2 Cr - 6.00%

Account Opening Fee

Annual Maintenance Fees

Savings

Account Type

Interest Rate

Balance Upto Rs. 25 Lacs-2.75 ,Balance Above Rs. 25 Lacs to Rs. 1 Crore-2.75 and Balance Above Rs. 1 Crore-

2.90

0

Account Opening Fee

0

Annual Maintenance Fees

Saving/salaried

Account Type

Purpose or Field of Education

Loans will be extended to deserving/ meritorious students for pursuing full time courses at selected premier and reputed institutions identified by the Bank.

15 Years

Maximum Loan Tenure

1.5 Crores

Maximum Loan Amount

12 months after the completion of the course.

Grace Period

Purpose or Field of Education

The Scheme seeks to extend financial assistance to deserving/meritorious wards of Defense & Indian Coast Guard Personnel for pursuing higher education in India and abroad.

Easy repayment over 15 years through EMI

Maximum Loan Tenure

Studies In India- Maximum Rs. 40 lakhs

Studies Abroad- Maximum Rs. 1.50 Cr

Maximum Loan Amount

6 months grace period provided to create mortgage of property offered as security with Bank.

Grace Period

Purpose or Field of Education

Loan for pursuing higher education in Select Premier Institutions of the country

15 Years

Maximum Loan Tenure

The maximum loan amount can be upto Rs. 40 Lacs

Maximum Loan Amount

-

Grace Period

Purpose or Field of Education

SBI Global Ed-Vantage is an overseas education loan exclusively for those who wish to pursue full time regular courses at foreign colleges/universities.

15 Years

Maximum Loan Tenure

1.5 Crores

Maximum Loan Amount

Repayment will commence 6 months after completion of the course.

Grace Period

Purpose or Field of Education

Loans will be extended to deserving/ meritorious students for pursuing full time courses at selected premier and reputed institutions identified by the Bank.

15 Years

Maximum Loan Tenure

The maximum loan amount can be upto Rs. 30 Lacs

Maximum Loan Amount

-

Grace Period

Purpose or Field of Education

The funds from the Axis Bank Balance Transfer Education Loan are used to pay off your existing education loan, not for any new educational expenses.

Up to 15 Years

Maximum Loan Tenure

Unsecured Loan upto INR 1 Cr. (For Abroad)

Unsecured Loan up to INR 75 Lakhs (For Domestic)

Maximum Loan Amount

Grace period is different from case to case basis.

Grace Period

Purpose or Field of Education

Unsecured Loan upto 40Lakhs to working professionals

15 Years

Maximum Loan Tenure

Unsecured Loan upto INR 40 Lakhs

Maximum Loan Amount

Grace period is different from case to case basis.

Grace Period

Purpose or Field of Education

Unsecured Loan for Abroad universities on the basis of GRE score

15 Years

Maximum Loan Tenure

Unsecured Loan upto INR 50 Lakhs

Maximum Loan Amount

Grace period is different from case to case basis.

Grace Period

Purpose or Field of Education

Education Loans for full-time Premier Courses In India

15 Years

Maximum Loan Tenure

Unsecured Loan upto INR 75 Lakhs

Maximum Loan Amount

Grace period is different from case to case basis.

Grace Period

Fixed/Short Term Deposit

Individual - Single Accounts

Two or more individuals - Joint Accounts

Sole Proprietory Concerns

Partnership Firms

Illiterate Persons

Blind Persons

Minors

Limited Companies

Associations, Clubs, Societies, etc.

Trusts

Joint Hindu families (accounts of non-trading nature only)

Municipalities

Government and Quasi-Government Bodies

Panchayats

Religious Institutions

Educational Institutions (including Universities)

Charitable Institutions

Interest Rate

Up to 6.65%

Short Term

Fixed Deposit Type

Up to 6 months.

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

Interest Rate

Up to 7.95%

Recurring

Fixed Deposit Type

3 months to 10 years.

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

Double Benefit Term Deposit

Individual — Single Accounts

Two or more individuals — Joint Accounts

Sole Proprietory Concerns

Partnership Firms

Illiterate Persons

Blind Persons

Minors

Limited Companies

Associations, Clubs, Societies, etc.,

Trusts

Joint Hindu Families (accounts of non-trading nature only)

Municipalities

Government and Quasi-Government Bodies

Panchayats

Religious Institutions

Educational Institutions (including Universities)

Charitable Institutions

Interest Rate

Up to 7.95%.

Regular

Fixed Deposit Type

6 months to 120 months.

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

BOI Quarterly Deposit

Individual — Single Accounts

Two or more individuals — Joint Accounts

Sole Proprietory Concerns

Partnership Firms

Illiterate Persons

Blind Persons

Minors

Limited Companies

Associations, Clubs, Societies, etc.

Trusts

Joint Hindu Families (accounts of non-trading nature only)

Municipalities

Government and Quasi-Government Bodies

Panchayats

Religious Institutions

Educational Institutions (including Universities)

Charitable Institutions

Interest Rate

Up to 7.90%

Quarterly Deposit

Fixed Deposit Type

Up to 10 years.

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

Star Monthly Income Fixed Deposit

Individual — Single Accounts

Two or more individuals — Joint Accounts

Sole Proprietory Concerns

Partnership Firms

Illiterate Persons

Blind Persons

Minors

Limited Companies

Associations, Clubs, Societies, etc.

Trusts

Joint Hindu Families (accounts of non-trading nature only)

Municipalities

Government and Quasi-Government Bodies

Panchayats

Religious Institutions

Educational Institutions (including Universities)

Charitable Institutions

Interest Rate

Up to 7.90%

Monthly Deposit

Fixed Deposit Type

Up to 10 years

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

Interest Rate

Interest rates keep fluctuating from time to time due to changes in the Repo rate.

Floating Interest Rate

Fixed Deposit Type

1 to 3 years.

Fixed Deposit Tenure

CRISIL A1+

Credit Rating

Interest Rate

9.25%

Maximum 8 years

Maximum Loan Tenure

Based on the

customer's need

Maximum Loan Amount

Not required

Minimum CIBIL Score

Interest Rate

9.25%

Upto 12 Months

Maximum Loan Tenure

INR 25 Lakhs

Maximum Loan Amount

Not required

Minimum CIBIL Score

PNB Gen-Next – Housing Loan for Salaried

All salaried employees with a minimum of 3 years experience.

Co-borrower will also be salaried class

Upto the age of 40 years.

In the case of multiple borrowers whose income has been taken for arriving at the loan eligibility and repaying capacity, one borrower must be at least up to the age of 40 years and others may be maximum upto the age of 45 years.

Further, where the income of the applicants is not being taken for arriving at the loan eligibility and they are owners/co-owners in the property, they are to be made co-borrowers under this scheme without referring his/her age.

Minimum net monthly salary: Rs.35000.

.png)

Interest Rate

For Fixed: 9.40% to 11.60% per annum. For Floating: 8.40% to 10.10% per annum.

Up to 30 years.

Maximum Loan Tenure

No limit

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Pradhan Mantri Awas Yojana

Individuals from Economically Weaker Section (EWS) & Low Income Group (LIG) category. Joint owners from the same family are also eligible.

EWS households - Households having an annual income up to Rs.3,00,000 (Rupees Three Lakhs only)and house size with carpet area up to 30 square meters.

LIG households - households having an annual income above Rs.3,00,000 (Rupees Three Lakhs) and up to Rs.6,00,000 (Rupees Six Lakhs)and house size with carpet area up to 60 square meters.

.png)

Interest Rate

8.85% onwards. Up to 6.5% after subsidy.

30 years

Maximum Loan Tenure

30,00,000

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Interest Rate

For Floating: 8.45% to 10.10% per annum. 9.45% to 11.60% for Fixed.

For repairs/renovation/alterations to the house/flat: 15 years.

For others: 30 years.

Maximum Loan Tenure

For construction/purchase of house/flat: No limit.

For purchase of land/ Plot for house building/repairs/renovation/alterations: 50 lakh.

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Interest Rate

For Fixed: 9.40% to 11.60% per annum. For Floating: 8.40% to 10.10% per annum.

Up to 30 years.

Maximum Loan Tenure

No limit

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Interest Rate

For Fixed: 9.40% to 11.60% per annum. For Floating: 8.40% to 10.10% per annum.

Up to 30 years.

Maximum Loan Tenure

1,00,00,000

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Interest Rate

For Fixed: 9.55% to 11.75% per annum. For Floating: 8.55% to 10.25% per annum.

Up to 30 years.

Maximum Loan Tenure

No limit

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Home Improvement Loan

Age: Applicant should be between 21 and 65 years old.

Income: Applicants' income and loan requirements will be considered. Other factors such as liabilities, assets owned, and credit score can also influence eligibility.

Interest Rate

8.75% to 17.75% per annum.

Up to 15 years.

Maximum Loan Tenure

25,00,000

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Composite (Plot Purchase & Self Construction)

Age: Applicant should be between 21 and 65 years old.

Income: Applicants' income and loan requirements will be considered. Other factors such as liabilities, assets owned, and credit score can also influence eligibility.

Interest Rate

8.75% to 17.75% per annum.

20 years

Maximum Loan Tenure

50,00,000

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Purchase and Construction Loan

Age: Applicant should be between 21 and 65 years old.

Income: Applicants' income and loan requirements will be considered. Other factors such as liabilities, assets owned, and credit score can also influence eligibility.

Interest Rate

8.75% to 17.75% per annum.

20 years.

Maximum Loan Tenure

75,00,000

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

Interest Rate

For Floating: 10.76% to 18.35% per annum. For Fixed: 12.75% to 26% per annum.

Up to 20 years.

Maximum Loan Tenure

Up to 20 lakh.

Maximum Loan Amount

Not specified by the bank.

Minimum CIBIL Score

INR 400

Annual Fees

Sharekhan provides a comprehensive range of charting features and technical analysis tools to assist traders in making informed investment decisions. The platform offers various types of charts, including line charts, candlestick charts, and bar charts, with customizable timeframes and indicators.

Special Feature

INR 600 per year towards account maintenance

Annual Fees

It offers comprehensive investment portfolio management and tracking capabilities, empowering users to efficiently manage their investments in a single platform.

Special Feature

Fees and Charges

84 months

Maximum Loan Tenure

Up to ₹1 crore

Account Opening Fees

Fees and Charges

84 months

Maximum Loan Tenure

Account Opening Fees

Fees and Charges

84 months

Maximum Loan Tenure

Up to ₹1 crore

Account Opening Fees

Fees and Charges

Up to 5 years

Maximum Loan Tenure

Up to ₹1 crore

Account Opening Fees

Fees and Charges

84 months

Maximum Loan Tenure

Up to ₹1 crore

Account Opening Fees

Fees and Charges

84 months

Maximum Loan Tenure

Account Opening Fees

Fees and Charges

up to 84 months

Maximum Loan Tenure

Up to Rs 25 lakh

Account Opening Fees

Fees and Charges

up to 60 months

Maximum Loan Tenure

upto Rs. 10.00 lakhs

Account Opening Fees

Fees and Charges

upto 6months

Maximum Loan Tenure

upto 2 lakhs

Account Opening Fees

Fees and Charges

upto 84 months

Maximum Loan Tenure

upto Rs. 25.00 lakhs

.png)

.png)

.png)

.png)

.png)